Role: Service Design Co-Lead

Partner/Client: PepsiCo

Industry: FMCG - Savoury Seasonings

Project: Connected Flavour Intelligence

Year: 2024

Discover

Transforming fragmented global flavour data into a unified, accessible ecosystem that unlocks insight, reduces risk, and enables smarter product adaptation.

If you’ve ever travelled abroad and picked up a bag of your favourite crisps, you’ll know the quiet surprise: the flavour is the same… but not quite. Slightly hotter in one country, saltier in another, richer somewhere else.

These tiny differences aren’t accidental, they’re the result of a highly complex global process. At PepsiCo, flavours don’t simply transfer from one region to another, they are lifted and adapted (L&A) through PepsiCo’s internal system, FlavourBank. Flavours are reformulated to meet each market’s regulations, ingredient restrictions, cultural expectations, cost targets, sustainability commitments, and supply chain realities. It’s a complex web of decisions, handovers, and data.

This requires many teams across the world working in sync. But over time, systems and workflows had become fragmented, inconsistent, and difficult to navigate. Data was duplicated or incomplete, local workarounds had evolved over time, and each region had its own unofficial version of the Lift & Adapt process.

PepsiCo’s 2030 Connected Flavour Intelligence Vision set out to change that. The goal was to build a future where flavour data is accurate, connected, and trusted. A future where global teams can collaborate more easily, and where product adaptation becomes faster and more innovative. Ultimately, the vision aimed to transform a fragmented system into one that enables smarter, more confident decision-making across every region.

As part of Phase 2, I co-led the Service Design workstream, helping reveal how Lift & Adapt actually happened across regions today, identifying the systemic barriers holding it back, and what would need to change for PepsiCo to realise its long-term vision.

To understand why the Lift & Adapt process varied so widely across PepsiCo, we used a global discover approach and conducted 24 in-depth interviews with flavour developers, regulatory specialists, procurement teams, and R&D leads across Europe, AMESA, APAC, LATAM, and North America. Each conversation revealed a different lived reality shaped by local regulations, inherited habits, resource constraints, and organisational culture.

For each participant, we captured:

Key takeaways about their role, responsibilities, and priorities

Process maps showing their input to the Lift & Adapt workflow

Screenshots and step-by-step walkthroughs of how they moved through FlavourBank and any external systems

Pain points, workarounds, and moments where data became inaccurate or difficult to trust

Key moments influencing whether they chose Lift & Adapt or New Product Development (NPD) - a decision that often explained why data became duplicated, outdated, or inconsistent between markets

Which regions or products they typically lifted flavour formulations from, revealing hidden dependencies and informal pathways

This allowed us to compare regional differences, uncover shared frustrations, understand where nuance was essential, and where standardisation could help strengthen global consistency.

During these interviews, clear patterns emerged. Although FlavourBank was intended to be the global source of truth, it was being used in completely different ways across regions. Some markets followed a rigorous, structured process; others relied heavily on interpersonal knowledge or local spreadsheets. Workarounds passed down from senior team members had quietly become embedded into regional culture, creating friction at scale.

Define

Using the insights gathered, we moved into synthesis - transforming fragmented individual interviews into a clear, shared understanding of how Lift & Adapt actually operated across PepsiCo. Because the process differs depending on context, we created three detailed use-case journey maps capturing the end-to-end workflow for:

PEP+ (Sustainability & Commitments)

Each use case represented a critical part of the Lift & Adapt ecosystem, and mapping them separately allowed us to surface the unique challenges, dependencies, and data behaviours within each function.

Multi-regional Journeys

Instead of documenting an “ideal” process, we mapped every region’s real workflow (Europe, AMESA, APAC, LATAM, and North America) into a single, consolidated view within each use case. This allowed us to identify:

Where teams aligned/diverged with PepsiCo’s intended Lift & Adapt process

Where steps were added, skipped, duplicated, or re-ordered

Where local workarounds had quietly become the norm

How inherited habits from senior colleagues shaped informal processes

Where data inaccuracies originated (often upstream, not at the point of entry)

Where dependencies caused bottlenecks, rework, or inconsistent outputs

How regulatory, costing, and sustainability pressures differed by market

Where handovers broke down due to unclear ownership or missing information

Where opportunities for UX improvement and process standardisation emerged

This synthesis became the foundation for defining a future where flavour data could finally flow in a clear, connected, and consistent way across PepsiCo.

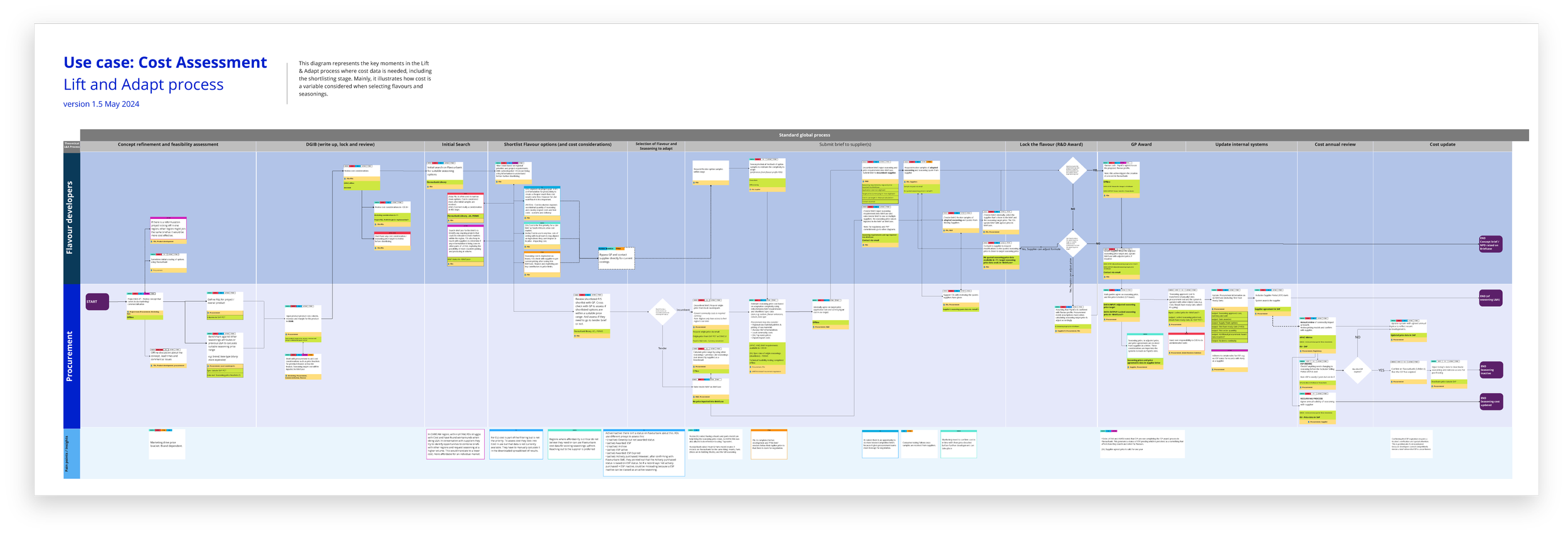

Cost/Procurement Use Case

Cost assessment focused on determining whether an existing seasoning could meet a project’s target price. Developers and procurement teams cross-checked supplier quotes and formulation complexity using spreadsheets, supplier conversations, or offline notes because cost data in FlavourBank was often incomplete or mistrusted.

Early filtering relied on proxy indicators such as “active/inactive” status, but these were inconsistently used across regions. Tendering added further iteration as suppliers revised formulations to meet cost targets, and once prices were agreed, teams manually entered them into systems like Briefcase or SAP PGT. Award steps, such as GP award or ESP updates, were inconsistently completed, creating confusion during shortlisting.

Overall, the process was manual, effort-intensive, and varied significantly across markets, making cost verification slow and inconsistent.

Regulations Use Case

Regulatory assessment required flavour developers to interpret region-specific rules and adapt formulations accordingly, but the data they needed was scattered across DGIB, Briefcase, PERMS, ISSQ, SAP 4HANA, local SharePoints, and offline files. Because this information was often missing, outdated, or contradictory, teams relied heavily on manual checks or direct conversations with regulatory specialists.

When shortlisting flavours, regions applied different filters based on local requirements, for example:

EU: sodium limits, colour restrictions, NutriScore

APAC: GMO rules, artificial colour restrictions

LATAM: salt certifications

Parts of APAC: halal requirements

Several regions: restrictions on MSG and specific additives

Regulatory teams were engaged at different stages depending on the market, leading to inconsistent influence on shortlisting and frequent rework when flavours failed compliance checks late in the process. Suppliers also had to enter specification data into multiple systems, creating duplication, delays, and repeated clarification loops.

Overall, the regulatory workflow was fragmented, highly variable across regions, and dependent on manual interpretation and repeated verification to ensure compliance.

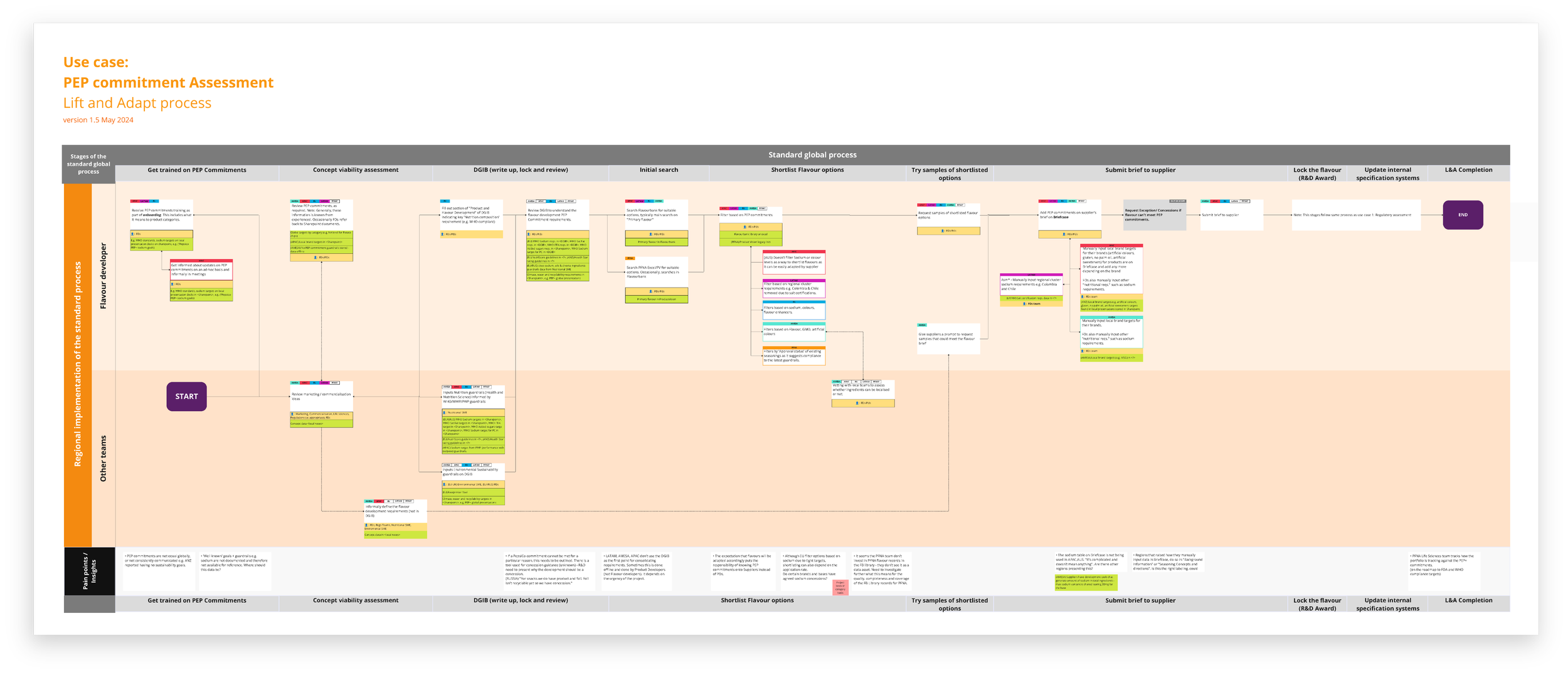

PEP+ Use Case

The PEP+ assessment process began with flavour developers gathering nutritional, environmental, and brand guardrails — often from scattered sources because regions stored and interpreted PEP+ data differently. Some teams entered requirements into DGIB, while others tracked them offline, creating inconsistency in how standards such as sodium reduction targets, WHO guidelines, NutriScore requirements, GMO rules, and sustainability metrics were applied.

Much of the knowledge required to apply PEP+ was tacit rather than documented, meaning developers relied heavily on experience or local SMEs to verify feasibility and decide whether commitments could realistically be met.

Overall, the process was fragmented, region-specific, and reliant on manual interpretation, leading to inconsistent application of PEP+ commitments across markets.

Design

For confidentiality reasons, the specific screenshots, new system flows, and UX concepts created for PepsiCo cannot be displayed publicly. I’m happy to discuss the analysis approach and high-level improvements in more detail upon request.

Impact

Although this was an early discovery and design phase, our work fed directly into PepsiCo’s next steps and made measurable progress:

Informed PepsiCo’s 2030 roadmap

Our insights shaped how global flavour data, systems, and processes would be reimagined over the next decade.Supported a pilot that reduced user error tickets by ~25%

UX and workflow recommendations were trialled in a pilot region, improving data accuracy and reducing rework.Established a shared global understanding

For the first time, teams across continents saw their full end-to-end workflow compared side-by-side.Elevated the importance of data connectivity

The project positioned flavour data as a strategic asset within PepsiCo’s digital agenda.

This project taught me the power of designing for global complexity: how systems evolve through behaviour, how workarounds become culture, and how meaningful transformation starts by making invisible processes visible.

This workstream also reinforced a key lesson: you can’t design the future of a system until you understand the lived reality of the people who use it every day.

It was a privilege to help PepsiCo take its next steps toward a connected, insight-driven flavour ecosystem.